⚡ Tools To Track Binance Outflows, New Etherscan Filters Are Here, and More!

Discover the latest and greatest Crypto & Web3 products

💡 Intro

Most of the news today is on the SEC + Binance.

While important, we don’t want to cover the same stories so instead we’ll show you how to verify for yourself one of today’s news cycles: Binance outflows.

Exchange Inflows and Outflows Are Important To Watch As They Can Affect The Following:

Exchange Health: Tracking outflows helps assess the solvency of a crypto exchange, as consistent outflows exceeding inflows may signal a potential lack of funds, indicating issues with the exchange's financial health.

Liquidity: By monitoring outflows, investors can gauge the liquidity available on an exchange; excessive outflows might reduce liquidity, increasing the risk of price slippage during trades.

Operational Efficiency: Monitoring the speed and efficiency of inflows and outflows can also give a sense of an exchange's operational efficiency. If transactions are slow or frequently fail, it could indicate technical issues with the exchange.

With that in mind, here’s some free tools you can use for tracking future exchange events.

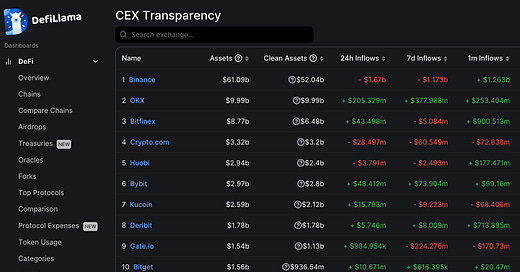

DeFiLlama Centralized Exchange Transparency Page:

This one is our favorite, as its extensive and has most of the top exchanges on it.

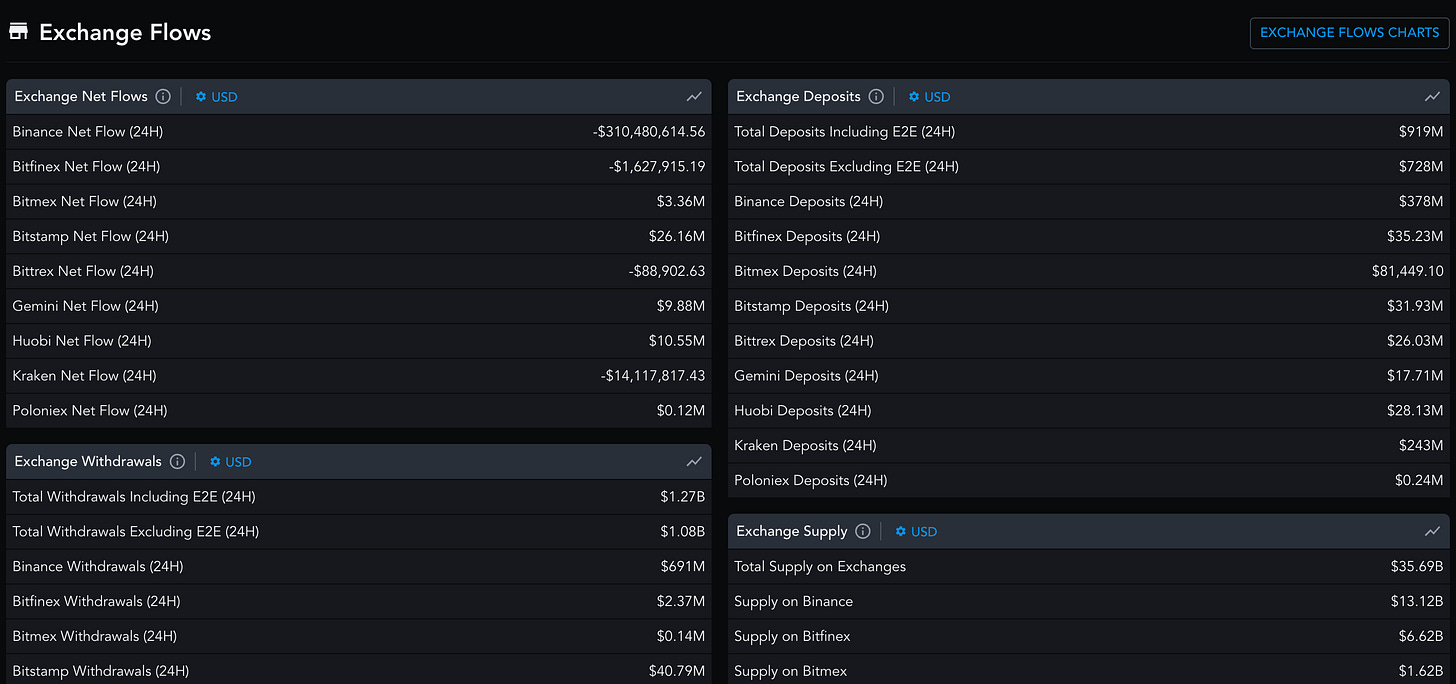

Another good resource, Messari has a free page here that breaks down Net Flows, Withdrawals, Deposits, and Supply.

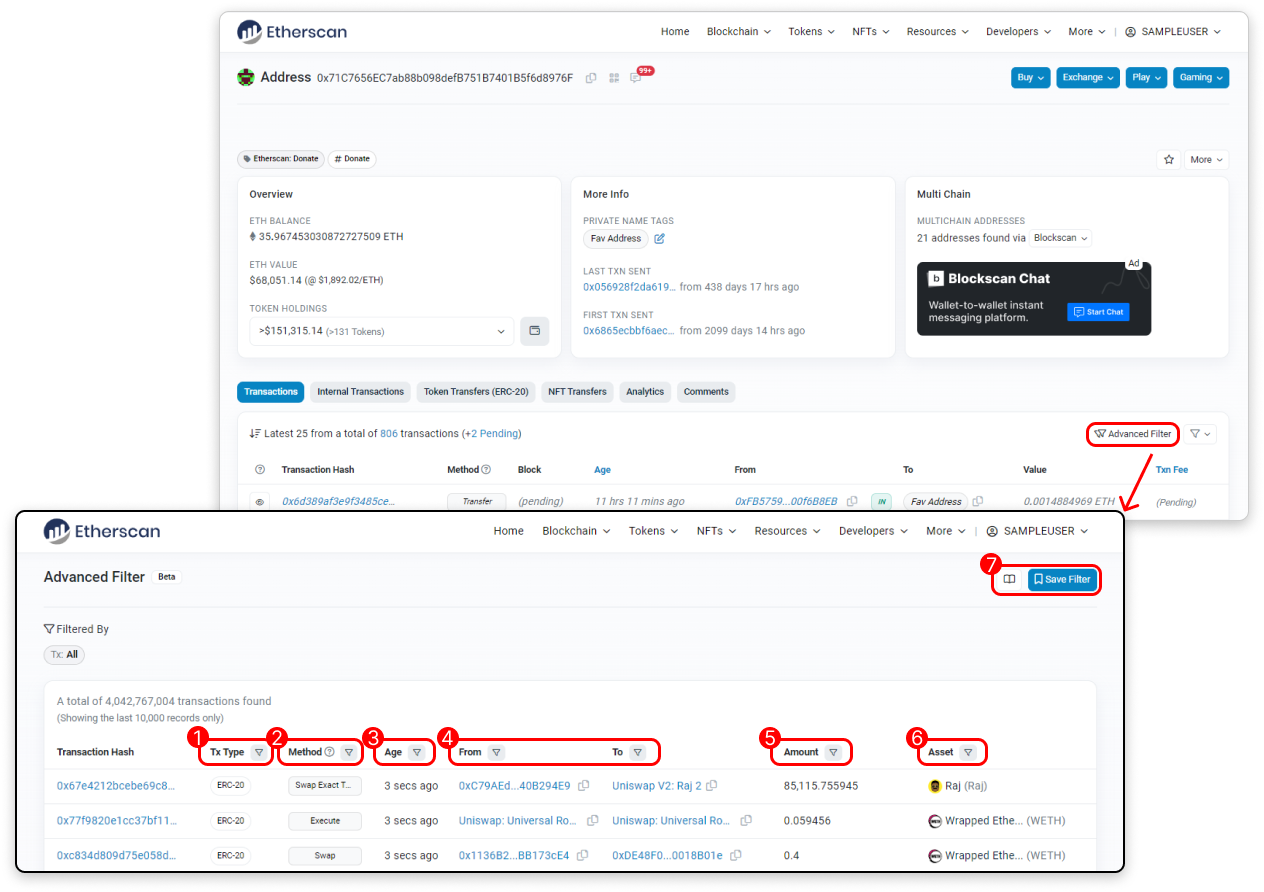

Etherscan Adds Advanced Filtering Directly On Site: Etherscan launched a Beta version of advanced filtering that’s certainly worth checking out if you’re a trader or investor.

Etherscan is one of the most popular blockchain explorer tools and with this latest update, it’s way easier to find / analyze your transactions without needing to go off platform to another tool.

🔥 Why This Update Matters:

Saves Time Analyzing Txts / Addresses: Instead of finding another tool to analyze your wallet txts, you can use their GUI directly on platform.

No SQL / Coding Knowledge Required: Instead of needing SQL knowledge for Dune Analytics, you can use their point-and-click filters to find the same information without needing to code.

We wish this was ready for last tax season 😅 but at least they’ve finally added it now.

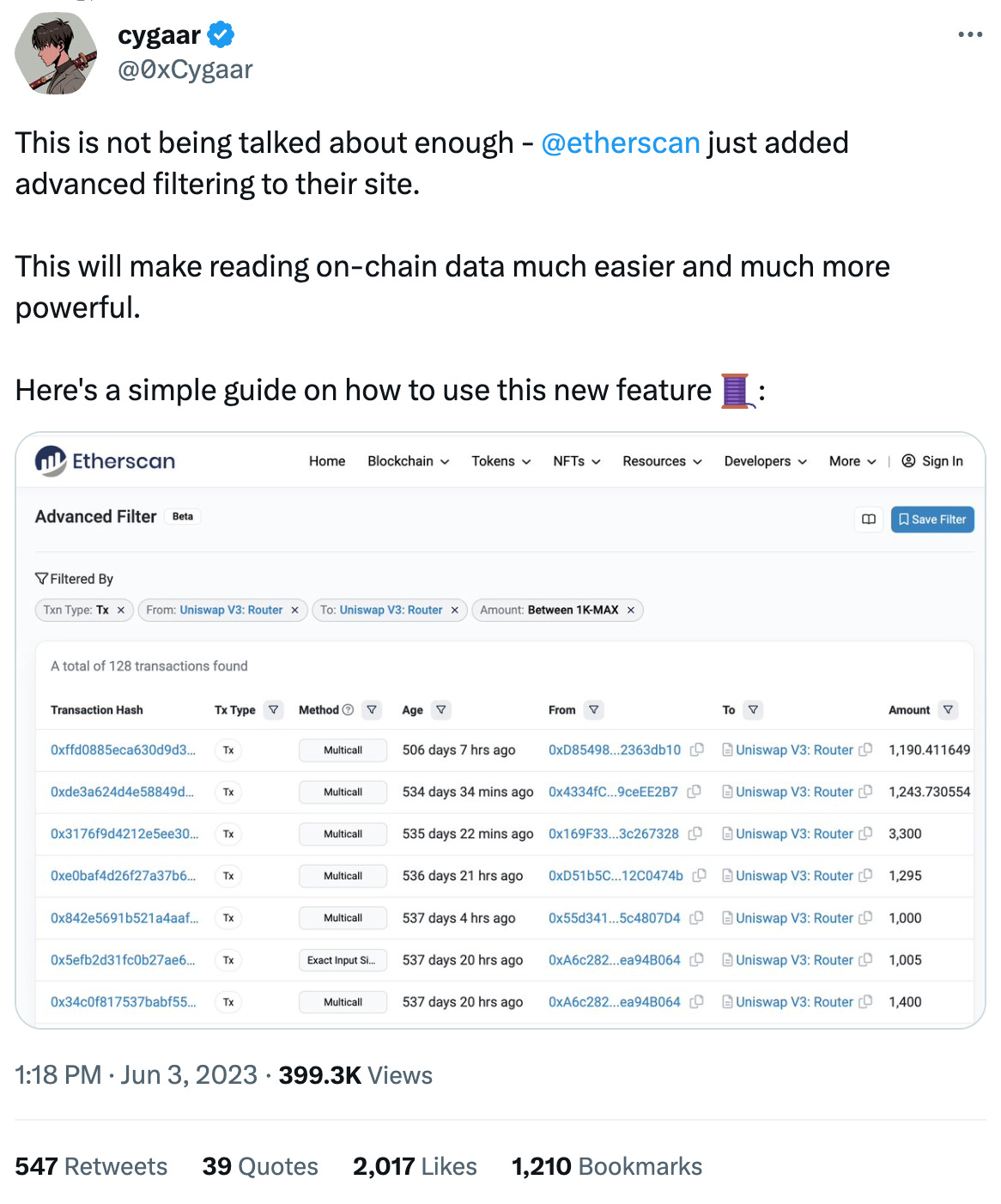

Good thread below, showcasing specific use cases:

Kakarot / Undisclosed — Kakarot Labs, a type 2.5 zkEVM, incorporated and successfully closed a pre-seed round with leading investors. — Tweet

Meanwhile / $19M — Meanwhile, a crypto-based life insurance startup raised $19 million in two seed rounds. The initial round was led by Sam Altman, CEO of OpenAI and founder of Worldcoin, along with Lachy Groom, former head of Stripe issuing. — The Block

Argus Labs / $10M — Haun Ventures led a $10 million seed round for crypto gaming startup Argus Labs, with participation from Elad Gil, Balaji Srinivasan, Siqi Chen, Kevin Aluwi, Sunny Agarwal, Calvin Liu, Scott Moore, and more — The Block

SafeBay Finance / $1.1M — SafeBay Finance, a treasury management protocol, secured $1.1M in a seed round with participation from Borderless, Algorand Foundation, and Axl Ventures. — Tweet

👉 Brought to You by Cryptosteel: the premier backup tool for your cryptographic private key or seedphrase.

The Cryptosteel Capsule is a pocket-sized stainless steel device designed to securely store keys or seedphrases (its a physical set of steel letters)

Spot On Chain

"Spot the opportunities and unlock insights with on-chain data.”

Type of Product: On-Chain Analytics

Purpose of Tool: Spot On Chain is an advanced blockchain data analysis tool that helps traders of all levels make smart decisions with confidence.

Very cool on-chain data analytics tool that has great UI/UX.

Their twitter account also tweets good analysis on hacks, token movements, whales, etc.

Streamlined on-chain signals – Get ahead of the game by scrolling through our feeds for quick insights.

Personalized & optimized transaction alerts – Receive notifications when wallet addresses have on-chain activity without complicated settings or excessive data.

Multichain token flow visualizer – View wallet activities along with token price fluctuation to identify buying/selling trends quickly and easily.

Smart traders and whale tracker – Stay informed about smart trader movements in the market to know when to buy or sell cryptocurrency assets.

Mobile friendly with multichain wallet – A holistic integration between SOC and your own wallet in a mobile app for easy access anytime, anywhere!

Team / Funding / Backers / Other Info: As of this writing, Spot On Chain has over 100,000 trending token alerts and a proven success rate of over 70%, Spot On Chain covers more than 50 tokens, serving a user base of over 20,000 people. The platform has generated over 10,000 graphs to support its analysis. Spot On Chain is also backed by notable names such as Animoca Brands, Skyvision Capital, Polygon, Everse Capital, Skyman Ventures and several others.

Link to product | Link to TFC listing

Zora

“The best place to mint"

Type of Product: NFT Creator Tool

Purpose of Tool: Zora is a decentralized protocol where anyone can buy, sell, and create permissionsless NFTs. It is powered by the Ethereum blockchain and has tools that make it easy to get started building.

Zora is one of the bigger tools for minting artist & free NFTs.

They just launched their own L2, which is getting a lot of coverage as people are speculating there might be a future airdrop/reward (as they previously raised $60M in funding. This is still unconfirmed.

Drops: Collections in which each NFT can have differing artworks and metadata; gas-efficient and no-code UX for deployment of NFT metadata and smart contracts.

Editions: Collections of identical NFTs at a fixed price; limited number of editions available to mint or release an Open Edition.

Finders Fee: Creators are rewarded when anyone uses their link to buy an NFT; incentivizing users to promote artwork.

Zora v3: Guarantees artists royalties on chain with updated versions deployed by the DAO (Decentralized Autonomous Organization).

Team / Funding / Backers / Other Info: Zora has recently secured $60M in investments from big names like Coinbase Ventures, Haun Ventures, and Kindred Ventures. The project has been gaining attention on Twitter, with over 90k followers and major influencers and projects keeping a close eye on it.

On May 25, 2023, Zora launched a testnet for their platform and announced their L2. Learn more here: : Link

Link to product | Link to TFC listing

Caviar

“We solved the liquidity problem for NFTs."

Type of Product: NFT AMM

Purpose of Tool: Caviar is an on-chain automated market maker (AMM) protocol that enables users to trade NFTs with ERC20 tokens and ETH. It replaces the traditional order book model with liquidity pools and AMM algorithms, allowing users to obtain fractional amounts of NFTs without a direct buyer or seller. Caviar also offers two types of liquidity pools: Shared Pools and Custom Pools.

Liquidity Pools: Smart contracts that hold NFTs and associated reserve assets. Users can deposit both NFTs and reserve assets in order to provide market liquidity, which earns them fees from trades in the pool they contribute to.

Automated Market Maker: An algorithm that determines NFT prices within liquidity pools based on supply and demand. This means users are able to trade NFTs for reserve assets without needing a direct buyer or seller. Prices are adjusted as trades occur.

Shared Pool: A single pool open to anyone who wants to deposit their NFTs and reserve assets into it. Those who do will receive LP tokens representing their ownership share of the pool, while also earning a 1% fee from each trade made against it. These shared pools classify NFTs into categories such as floor, mid, rare, and grail based on desirability level so they can be traded as entire collections if desired.

Custom Pool: Advanced pools created by liquidity providers with customizable parameters such as flash loan support, custom fee rates, concentrated liquidity, stolen NFT filtering or weighted NFTs.

Team / Funding / Backers / Other Info: On May 22, 2023, the Beta version of Caviar V2 has gone live. Caviar is gradually introducing new features and plans to make the platform available to everyone very soon.

The latest version includes some highly anticipated features such as custom pool creation with custom fees, concentrated liquidity provisioning, allowing or blocking stolen NFTs from your pool and ignoring or enforcing royalties in your pool. These exciting updates are sure to enhance user experience on the platform.

Link to product | Link to TFC listing

Dfns

"Web3 Wallets as an API”

Type of Product: Web3 Wallet Infrastructure

Purpose of Tool: Dfns provides users with secure and easy access to crypto assets. It allows developers to quickly and easily deploy their own crypto custody infrastructure while also providing streamlined features and security upgrades. Dfns offers scalability, DeFi access, compliance-friendly options, maximum security, and keyless wallets.

With its cloud-native development environment, developers can generate millions of configurable wallets at scale with the assurance of asset control and business continuity without offloading any responsibility for securing keys.

Scalable Wallets: Generate configurable wallets at scale with the ability to manage segregated accounts, sign transactions quickly, set up business rules, and monitor balance in real-time via API.

DeFi Access: Get unlimited access to trades on DeFi apps through low-level message and hash signing on Layer 1 & 2 blockchains as well as smart contracts.

Compliance Friendly: Set up rules for employees and partners such as limiting amounts or frequency of payments or assigning admin rights for each wallet.

Maximum Security: Keyless Wallets are enabled by multi-party computation (MPC) combined with zero-knowledge proofs which allows users to issue secret shares that can securely sign transactions while keeping them segregated during the entire wallet lifecycle process.

Team / Funding / Backers / Other Info: On May 9, 2023, Dfns announced the launch of their biometric-enabled MPC wallets that can be accessed on over 30 blockchains. This new development is considered a small revolution in the world of wallets. Learn more about it here: Link

Also last year on April 13, 2022, Dfns secured $13.5 million in seed funding from investors including White Star Capital, Hashed, Susquehanna, and the venture arms of Coinbase and ABN AMRO.

Link to product | Link to TFC listing

Solana | Communications Manager | Link to position

OKX | Data Analyst - Trading Team | Link to position

Illuvium | QA Web Tester | Link to position

Evmos | Software Engineer, Full Stack | Link to position

Chainflip Labs | Senior Full Stack Engineer for Web3 | Link to position

Paxos | Product Manager – Tokenization | Link to position

LayerZero | Business Development Representative - Defi | Link to position

Chiliz | Twitter Specialist | Link to position

How was the newsletter today? Your feedback helps me make this great.

Loved it | OK | Didn’t Like

Anything you want to see? Fill out this form and let us know!

Disclaimer: None of this is to be deemed legal or financial advice of any kind. Always DYOR!